The consultation meetings were attended by representatives from taxation professional bodies, major law and accounting firms, various major corporations and business associations. Open your account instantly through the app anywhere across Australia. Transfer funds between banks in real-time using the New Payments Platform . Binah who specialise in delivering full scale construction services have utilised NAB’s new Islamic financing product on their latest development.

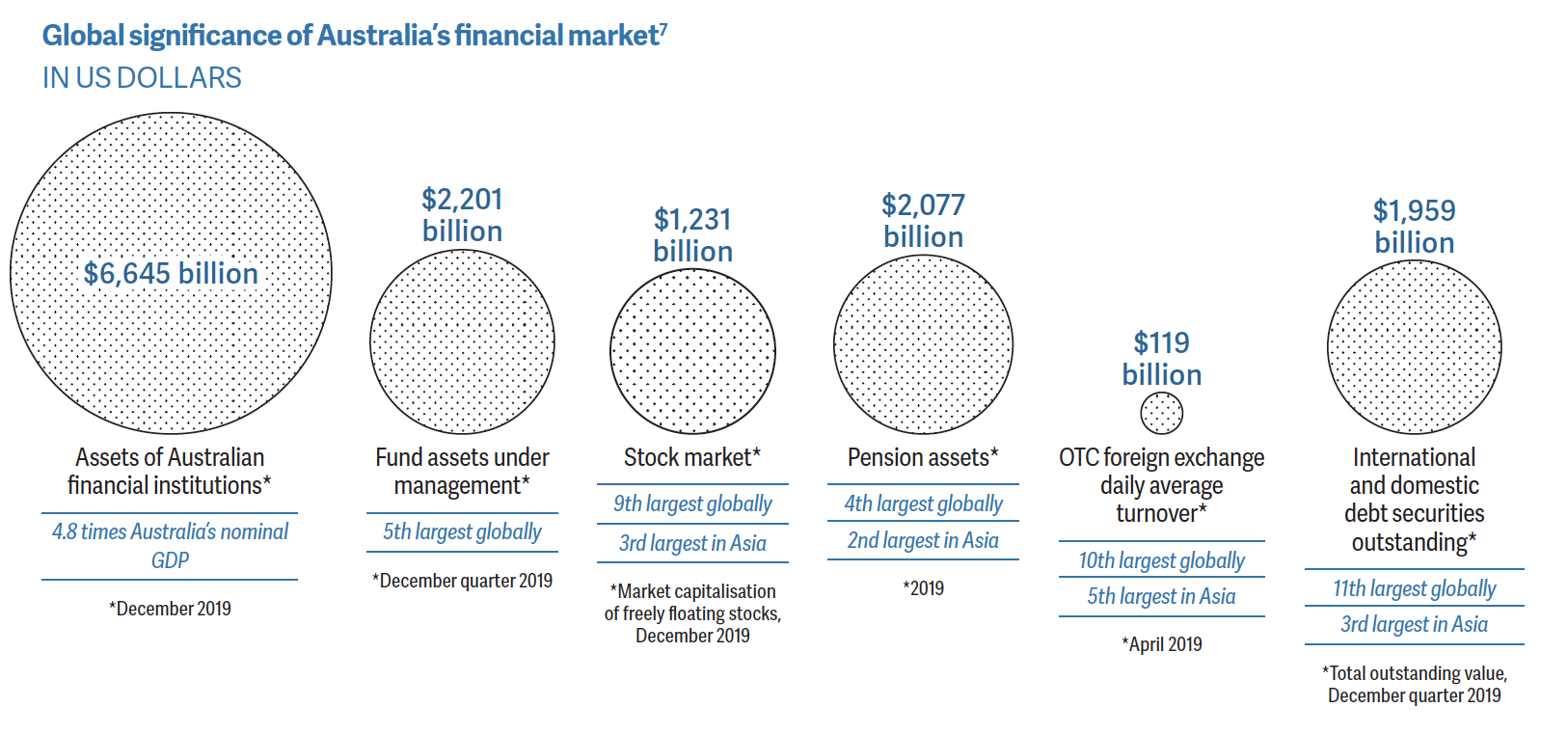

We’re working as fast as we can to achieve our full ADI licence and bring our products to the Islamic community and all Australians,” Mr Gillespie said. The report Islamic Finance concluded Australia has arguably the most efficient and competitive financial sector in the Asia-Pacific region, but there are further opportunities to expand our exports and imports of financial services. Australia is highly regarded internationally as a place to do business.

While the bank is not yet open for business , it has said it will offer a full suite of shariah-compliant retail and business banking services. And at the big end of town, one of the country's largest banks, NAB, is launching a specialised financing product for Islamic business customers, which the company believes is an Australian first for banking. If you wish to compare your Islamic home loans, in the above section “Are there any Islamic banking institutions in Australia? ” you’ll find list brokers and providers that specialise in Islamic home loans. ” you’ll find list brokers and providers that specialize in Islamic home loans.

When they wanted to buy a new car, they saved up and bought it outright. Melbourne couple Zehra and Halis Erciyas withdrew their superannuation from a major fund a few years ago and put it into one managed by a small Islamic finance company. One area the sector is tapping into – with some logistical wrangling – is consumer home loans, like those taken out by Melike and Ibrahim. The moral foundations of Islamic banking For many Muslims, “interest” is something that must be avoided because it is considered prohibited under Islamic ethical-legal norms.

For example, the bank might buy a $10,000 car and sell it to the customer for $13,000 – which can be repaid in instalments. Whether because of, or despite, the global financial crisis, the need for greater accommodation of Islamic finance as a positive influence on our economy is being recognised by companies here and potential partners overseas. An opportunity for Australia to benefit from its advantages is in the funds management sector. Australia has expertise, experience and a well recognised reputation worldwide in funds management; diversifying the sources of debt finance. In addition, the Government has established a cross agency interdepartmental process to examine whether there are any non-tax regulatory barriers to the development of Islamic finance in Australia. My trip to the Middle East illustrated the vibrancy and dynamism of the Islamic finance sector and identified opportunities for Australia and the Middle East to work together in matters involving Islamic finance.

PRESS RELEASE: Australia's first-ever Islamic bank is here Media Database

INSAAF exists to fulfil the increasing need for Muslim communities searching for financial solutions with experts in both areas to create an aligned result of equipment, vehicles or business success. IBA Group was originally founded by thirteen passionate Muslims who wanted to bring Islamic banking to Australia for the first time. Together with the original founders, IBA Group is owned by Abreco Group, a large UAE-based company. Similarly, for personal finance – Islamic Bank Australia would purchase the item and then sell it to the customer. For example, the bank might buy a $10,000 car and sell it to the customer for $13,000 – which can be repaid in instalments.

After you have settled you will have access to our on-line portal which is a convenient and secure way to pay bills, access your account balance and transaction history and make transfers and redraws. If you are refinancing, the valuation on the property is ordered immediately after you are granted a Conditional Approval. We will order a valuation of the property once you have provided us with a valid contract of sale. We will send you a conditional approval which gives you an indication of how much finance we may provide you. The conditional approval is also subject to certain conditions which may include a satisfactory valuation that is conducted by an independent valuer. We are rigorous about ensuring the Shariah integrity of our products through Shariah audits and on-going testing.

Maria Gil writes across all of our personal finance areas here at Mozo. Her goal is to help you think smarter about money and have more in your pocket. Maria earned a journalism degree in Florida in the United States, where she has contributed to major news outlets such as The Miami Herald.

While the bottom line is important, in a world where corporate governance and social impact adds to brand gravity, ethical consciousness must take precedence when developing products and services. Finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. To be eligible Islamic home loans, apart from having the Muslim faith, you’ll also need to provide proof of funds for your deposit, savings and employment history as well as information related to any other assets or liabilities you have.

The non-major bank has announced “significant” home loan growth over the financial year 2022, up more than $1 billion. When we look at the opportunities for delivering and engaging with various communities within the society, we begin to understand the significance of digital experiences. When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity.

It is very common in Muslim-majority countries and is growingly rapidly in Australia. With 13 Muslims as its founders, IBA Group was originally created to bring Islamic banking to Australia Islamic Car Finance Australia for the first time. “With the number of Muslims in Australia growing by more than 6 per cent every year, we’re excited to be bringing this new type of banking to the Australian community,” said Islamic Bank Australia CEO Dean Gillespie. We invite applications from suitably qualified and experienced professionals to join and support our College’s strategic directions and initiatives. Construction company Binah said the NAB’s sharia-compliant finance meant it could take on projects with development partners and fund them while maintaining core values of their faith.

This is where the Islamic financier buys the house for the client and then rents it to them over a fixed term, generally decades. One area the sector is tapping into – with some logistical wrangling – is consumer home loans, like those taken out by Melike and Ibrahim. "The customer is at risk and the bank is at risk, and in order to achieve that it's not a debt relationship, it's more like a partnership relationship," Asad Ansari says.

APRA grants restricted ADI licence to Australias first Islamic bank

You Islamic Bank Australia will need to show that you’re good at managing money and that you have saved money successfully in the past . The lender will need to be persuaded that your income is adequate to pay off the loan over the term you want. Bear in mind that your choice is not limited to bank based in predominantly Islamic countries. Some of the larger Australian banks also offer Sharia-compliant loans.

Generally, it’s not possible in Australia to provide a fixed rental for the entire term of a mortgage. Melbourne-based investment advisory firm Hejaz Financial Services has also applied for a banking licence after seeing huge demand for its sharia-compliant finance, mortgages and superannuation since 2013. And at least two entities are seeking a licence to establish Islamic banks in Australia, alongside non-bank financial institutions that already offer sharia-compliant services. Islamic Bank Australia (islamicbank.au) will be the first Australian bank to offer a full suite of retail and business banking services – all without interest and Shariah-compliant for the first time in Australia.

Islamic home loans come with many of the features that are also offered with traditional home loans. Compare the features among different lenders before deciding which home loan is right for you. For the period of the transaction, the buyer amortised the outstanding debt through rental instalments. With an Islamic home loan, you can choose the home and then the financial institution will buy it from the seller. This same financial institution then agrees to lease the home for a pre-determined period, which is known as Ijarah Muntahiyah Bittamlik.

While there are several foreign banks in Australia, including the Arab Bank and HSBC, few of them offer Islamic home loans. However, Westpac and National Australia Bank have introduced Sharia-compliant products to the market. None of the Islamic financing companies currently offering consumer finance products in Australia are licensed as fully fledged banks.

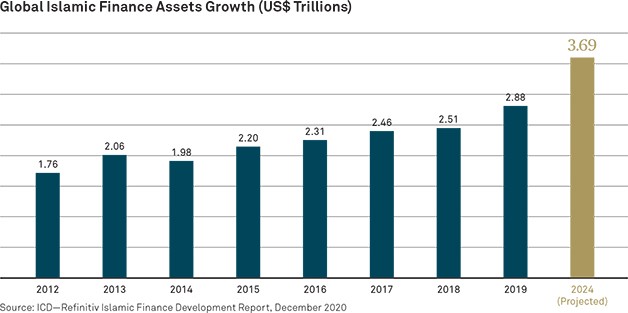

This unique Islamic finance market is growing internationally to the tune Halal Car Finance of nearly US$1 trillion, and could soon become a force in Australia as well. You should confirm any information with the product provider and read the information they provide. InfoChoice is one of Australia’s leading financial services comparison website. We've been helping Aussies find great offers on everything from credit cards and home loans to savings and personal loans and more for over 25 years.

At the start of the loan, that’s dictated by the size of the deposit that the homebuyer provides. You could say that the primary difference between a traditional Australian mortgage product and Islamic home loans is that with the former, the lender charges interest for providing a sum of money. However, with the latter, the financier charges for providing their share of sole occupancy of the property. “Just like any conventional facility in any other organisation, customers should be alert to the service aspect of the product. I believe Iskan Finance operates as an ethical business and we’re firm on NCCP compliance so people should take the comfort in the fact that we, and other providers, respect people’s rights under Australian law." While Islamic Bank Australia is not currently open for business, it plans to eventually offer a full suite of retail and business banking services in Australia.

If you decide to apply for a product you will be dealing directly with that provider and not with Mozo. Mozo recommends that you read the relevant PDS or offer documentation before taking up any financial product offer. Target Market Determinations can be found on the provider's website.

Sydney-based startup IBA Group, which is led by Muslim scholars, told ABC News they started the process with APRA to get a R-ADI a few years ago. "The question for them arose whether they could actually undertake the Islamic banking activities within the Australian framework. And the decision was made that that was quite a difficult prospect." Some time ago, Amanah Finance's Asad Ansari consulted for an offshore Islamic bank that was interested in setting up a branch in Australia. Imran says NAB isn't looking to play in the consumer Islamic finance space.

If you are refinancing, the valuation on the property is ordered immediately after you are granted a Conditional Approval. We will order a valuation of the property once you have provided us with a valid contract of sale. If you are going to buy at auction, you will, most likely, be legally bound to purchase the house. We will send you a conditional approval which gives you an indication of how much finance we may provide you. The conditional approval is also subject to certain conditions which may include a satisfactory valuation that is conducted by an independent valuer.

Why Splend's Flexi own plan is halal car finance

We use the guidance on national, international, and socio-economic issues outlined in Islamic code to help Australian Muslims to live and work accordingly while meeting and exceeding their business and financial goals. INSAAF exists to fulfil the increasing need for Muslim communities searching for financial solutions with experts in both areas to create an aligned result of equipment, vehicles or business success. Open your account instantly through the app anywhere across Australia. Transfer funds between banks in real-time using the New Payments Platform .

The first dealer then owes the second dealer the amount of money they transferred. It is informal, meaning that arrangements are based on trust and not official contracts. There is a vigorous debate about whetherinsurance is halal or haram. Some Islamic scholars do argue that traditional insurance is permissible because the intentions Halal Loans of insurance are good. But a Muslim can err on the side of caution and focus on cooperative insurance.

You can also contact other banks to find out if they offer Islamic home loan options. Keri is a financial services professional with significant experience in investment sales and marketing, strategy and management, superannuation and business consulting and governance, and an experienced company director. Melbourne-based investment advisory firm Hejaz Financial Services has also applied for a banking licence after seeing huge demand for its sharia-compliant finance, mortgages and superannuation since 2013.

Anyone can apply for an Islamic mortgage and the application is assessed on your financial circumstances, not your religion . You may find your deal more expensive due to the particular nature of Islamic mortgages and the fact that there aren’t many providers. Although you won’t be paying interest, you’ll be paying more than the selling price in the form of your rental or profit fee.

The way it works is that the financial institution mortgages the property and charges you an amount that you pay in rent. The more funds you repay, the more ownership you have in the property until it is paid off in full. Keep in mind that just because the institution doesn’t charge interest, doesn’t mean it doesn't charge a profit. The financial institution still makes a profit from leasing the property to you. InfoChoice will not accept liability for incorrect information.

“It’s the flexibility of the link between those two funds that should be attractive – a choice of income or capital, drawing on the benefits of both,” Dr Hewson said. The data, which is derived from a June survey of 1,002 broker customers and conducted by Honeycomb Strategy,… Hejaz Financial Services has been active in Australia for over a decade and assists Muslims in making various aspects of Australian finance, such as Supers and Investment, compliant with their religious beliefs. You’ll receive the latest industry news, tips and offers straight to your inbox. Many of our members are hard-working Muslims, who have been looking to earn a flexible income by becoming rideshare drivers.

Demystifying Muslim Mortgages

The lender will need to be persuaded that your income is adequate to pay off the loan over the term you want. An Islamic home loan starts when you choose a property and your lender agrees to buy it, in return for which you make a ijarah muntahiyah bittamlik agreement to live in the property for an agreed length of time and pay rent to the lender. Debt-based products that are sold at discounts to big investors are banned in Islamic finance, he said. Islamic finance prohibits transactions involving interest , speculation, investment in non-halal products such as alcohol, gambling or pork products, or those that involve excessive risk – these are haram . "You have a growing Muslim middle class whose needs need to be addressed by institutions like Crescent Wealth and MCCCA," said Ibn Arabi El Goni, head of product with Dubai-based DinarStandard, which produced the report. That's more difficult in Australia because stamp duty means such transactions are effectively double-taxed, said Andrew Johnston, the head of Islamic finance at law firm Sparke Helmore.

One area the sector is tapping into – with some logistical wrangling – is consumer home loans, like those taken out by Melike and Ibrahim. "The customer is at risk and the bank is at risk, and in order to achieve that it's not a debt relationship, it's more like a partnership relationship," Asad Ansari says. But that's been hard to achieve in Australia's mainstream banking system. If you are refinancing, the valuation on the property is ordered immediately after you are granted a Conditional Approval. We will order a valuation of the property once you have provided us with a valid contract of sale.

"Getting a banking licence is a fairly challenging thing to do in any case, but trying to start an Islamic bank in a country where almost nothing is set up to support Islamic banking is really challenging," he says. A R-ADI is a transitional banking licence that APRA introduced a few years ago to allow smaller operators to enter the market. Now two small local entities are trying to have another crack at setting up an Islamic bank in Australia using a new form of banking licence set up by the financial regulator, APRA. "One of the things they were looking at was the retail consumer markets, in particular banking," he says. The first deal under this service was just signed with a Sydney-based construction company, Binah. "We've recognised that the Islamic finance industry has grown at a rate of about 15 per cent since the 1990s," NAB's director of Islamic finance, Imran Lum, tells ABC News.

If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan. Finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. The providers of this style of finance all operate under the National Consumer Credit Protection Act and will make independent enquiries into your ability to meet the financial commitments without undue hardship.

According to the MCCA, the mortgage can either be seized by the funder or left with the borrower given that it is registered for full mortgage securities entitlement to the funder. It is also permissible to use a third party property as a security mortgage. Murabaha, an Islamic term, is defined as a transaction where the seller discloses the cost of its commodity, then adds some profit thereon, which is either a lump sum or based on a percentage. Michael Bleby covers commercial and residential property, with a focus on housing and finance, construction, design & architecture. Pension funds in Malaysia, Indonesia and Brunei were interested in exposure to Australian residential real estate, through rateable and tradeable securities called sukuk in Islamic finance, Crescent Finance managing director Sayd Farook said. He recently acquired a car,